Now that the 2022 tax returns are done (unless you asked for more time), it’s time to start thinking about next year’s taxes and how to plan ahead. The year 2023 brings some tax law changes and updates that you should know about. The government’s year-end funding introduces new retirement rules, and the Inflation Reduction Act from last year gives tax breaks for electric cars and home improvements. High inflation has also led to the adjustment of income tax brackets and other numbers. Here’s a list of the most important tax law changes for 2023 that we think you should know, especially if you want to save some money when you file your 2023 tax returns. So, take a look and get familiar with these changes now.

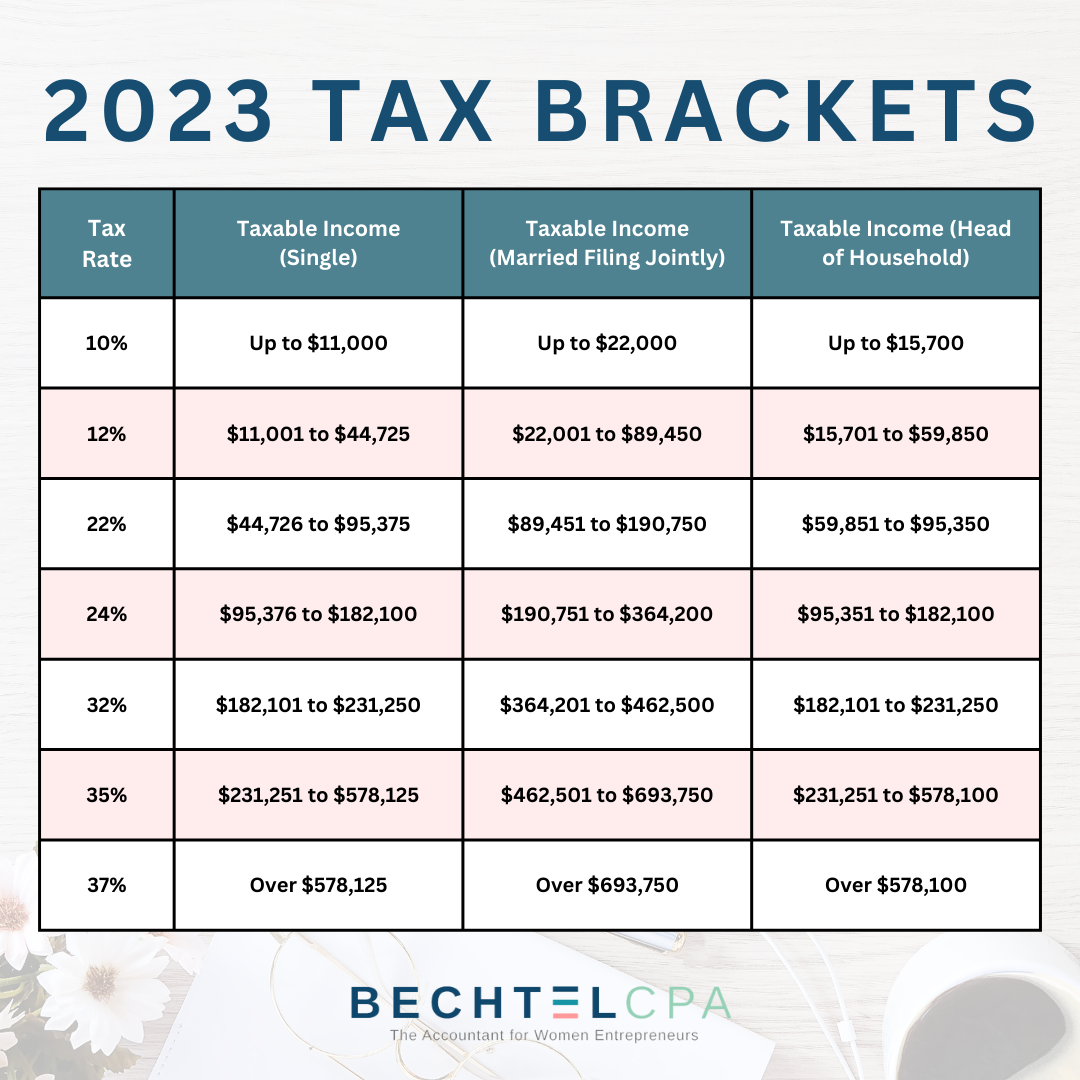

2023 Tax Brackets:

In 2023, while the tax rates remain unchanged, there is a noticeable difference in the income tax brackets compared to 2022. This change can be attributed to the increase in inflation.

Long-Term Capital Gains Tax Rates:

In 2023, the tax rates on long-term capital gains and qualified dividends remain unchanged. However, the income thresholds to qualify for different rates have been adjusted for inflation. For individual taxpayers, the 0% rate applies to those with taxable income up to $44,625 for single returns and $59,750 for head-of-household filers. The 20% rate starts at $492,301 for singles and $523,051 for heads of household. The 15% rate applies to filers with taxable incomes between the 0% and 20% breakpoints. Additionally, the 3.8% surtax on net investment income remains the same for 2023, applying to single individuals with modified adjusted gross income over $200,000 and joint filers with modified AGI over $250,000.

Standard Deduction:

In 2023, the standard deduction amounts have been increased to accommodate inflation. For married couples filing jointly, the standard deduction is $27,700, with an additional $1,500 for each spouse aged 65 or older. Singles can claim a standard deduction of $13,850, which increases to $15,700 if they are at least 65 years old. Head-of-household filers have a standard deduction of $20,800, with an additional $1,850 once they reach age 65. Blind individuals can add an extra $1,500 to their standard deduction, which increases to $1,850 if they are unmarried and not a surviving spouse. These adjustments reflect the updated standard deduction amounts for the 2023 tax year.

Residential Clean Energy Credit:

If you choose to install an alternative energy system in your home that utilizes renewable energy sources such as solar, wind, geothermal, or fuel cell technology, you may qualify for a tax credit. This credit applies to various equipment, including solar panels, solar electric equipment, solar-powered water heaters, wind turbines, and as of 2023, battery storage technology with a minimum capacity of three kilowatt hours. The credit amount is 30% of the total cost of the equipment and installation for renewable energy systems. This full credit will be available until 2032. From 2033, it will decrease to 26% and further decrease to 22% in 2034 before eventually expiring in 2035.

Energy-Efficient Home Improvement Credit:

Starting from 2023 until 2032, the tax credit for energy-efficient home improvements has undergone significant enhancements. The credit percentage has increased to 30% of the cost for specific types of insulation, boilers, air-conditioning systems, windows, and doors that are added to your residence. The previous lifetime credit limit of $500 has been replaced with a more generous $1,200 annual limit. However, this annual limit is adjusted to $500 for exterior doors and $600 for exterior windows, skylights, and other items. The annual limit is further increased to $2,000 for biomass stoves, hot water boilers, electric heat pumps, or natural gas heat pumps installed in the home. Additionally, homeowners can also claim a credit of up to $150 for the expenses related to a home energy audit. These revisions aim to provide homeowners with improved incentives to invest in energy-efficient upgrades.

Clean Vehicle Credit:

The tax credit for electric vehicle purchases has been revamped under the Inflation Reduction Act. It is now called the clean vehicle credit. The maximum tax break remains $7,500 for new EVs from 2023 to 2032. However, eligibility factors have changed.

EVs put in use after April 17, 2023 must meet a critical minerals requirement and a battery component rule (to qualify for the full credit). If only one factor is met, the credit is capped at $3,750. EVs put in use before April 18 are eligible for the full credit based on battery capacity, and final assembly must occur in North America for EVs placed in service after August 16, 2022.

The manufacturer sales threshold limit no longer applies to EVs purchased in 2023 and later.

New rules state that the manufacturer’s suggested retail price must not exceed $55,000 for sedans and $80,000 for vans, SUVs, and pickup trucks. There is also an income limit: the credit cannot be claimed if modified adjusted gross income exceeds $300,000 for joint filers, $225,000 for head-of-household filers, or $150,000 for single filers.

The government maintains a list of eligible clean vehicles, including EVs and fuel cell vehicles, on the website https://fueleconomy.gov/feg/tax2023.shtml.

Used EVs purchased from a dealer qualify for a smaller credit, either $4,000 or 30% of the sales price, whichever is lesser. The credit is not available if modified AGI exceeds $150,000 for joint filers, $112,500 for head-of-household filers, or $75,000 for single filers.

*If don’t qualify for this credit because your income exceeds the threshold, you could potentially qualify for the Commercial Clean Vehicle Credit if used for business purposes.*

New Rules for 1099K Forms:

In 2021, a law was passed requiring third-party settlement networks like PayPal, Venmo, and StubHub to issue Forms 1099-K to payees who receive over $600 a year for goods and services. Originally set to take effect in 2022, the lower reporting thresholds faced criticism, leading the IRS to postpone their implementation for one year.

Now, starting in 2023, the new rules apply, and 1099-K forms will be sent out in 2024. This means more individuals will receive 1099-K forms to use when filing their 2023 Form 1040. Examples include those selling tickets on StubHub for a profit or valuable toys on eBay. It’s important to note that 1099-K reporting is only for money received for goods and services, and it doesn’t apply to personal transfers using platforms like Zelle or Venmo to send money to family and friends.

Retirement Savings:

Starting in 2023, the age for required minimum distributions (RMDs) increases to 73 from 72 for traditional IRA and workplace retirement plan owners turning 72 after 2022. The penalty for not taking RMDs is now 25% of the missing amount, down from 50%, and can be reduced further for timely corrections.

In 2023, contribution limits for retirement plans and IRAs have increased. For 401(k), 403(b), and 457 plans, the maximum limit is now $22,500, with a $7,500 catch-up contribution for those aged 50 or older. The contribution limit for SIMPLE IRAs is $15,500, with an additional $3,500 for individuals aged 50 and above.

For traditional and Roth IRAs, the contribution limit is $6,500, with a $1,000 catch-up contribution for individuals aged 50 and above. Income ceilings for Roth IRA contributions have risen, and deduction phaseouts for traditional IRAs now start at higher income levels in 2023.

Lower-income individuals may qualify for the saver’s credit in 2023, with AGI thresholds of $36,500 for single filers and married individuals filing separately, $73,000 for married couples filing jointly, and $54,750 for head-of-household filers.

Health Savings Accounts:

In 2023, the annual limit for deductible contributions to Health Savings Accounts (HSAs) have increased. For self-only coverage, the cap has risen from $3,650 to $3,850, and for family coverage, it has increased from $7,300 to $7,750. Individuals born before 1969 can make an additional contribution of $1,000, the same as in 2022.

For qualifying insurance policies, the maximum out-of-pocket costs have changed. In 2023, family health plans must limit costs to $15,000 ($14,100 in 2022), and individuals with coverage must have a maximum of $7,500 in out-of-pocket costs ($7,050 in 2022). Minimum policy deductibles have also increased, with $3,000 for families and $1,500 for individual coverage ($2,800 and $1,400, respectively, in 2022).

Standard Mileage Rates:

In 2023, the standard mileage rate for business driving has increased to 65.5¢ per mile. The mileage allowance for medical travel and military moves has also risen to 22¢ per mile. However, the charitable driving rate remains unchanged at 14¢ per mile, as it is set by law.

Parking and Transportation Benefits:

In 2023, employers have the opportunity to enhance the benefits they provide to their employees regarding parking and transportation-related fringe benefits. The maximum tax-free parking amount provided by employers has increased from $280 to $300 per month for 2023. Similarly, the exclusion for mass transit passes and commuter vans has also increased to $300 for 2023, up from $280 in 2022. This allows employers to offer more generous benefits to support their employees’ parking and commuting needs.